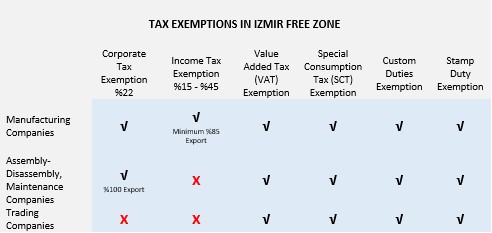

Companies producing in İzmir Free Zone are exempt from Corporate Tax.

If they export 85% or more of their production within the same year, their employees are exempt from Income Tax.

Since the Free Zones are considered as a part of the Customs Union treaty between Turkey and the European Union, the products produced in the Izmir Free Zone can be sent to EU member countries freely if an A.TR certificate is issued.

In addition, no customs duty is applied to products from countries outside the Customs Union that are subject to customs duty in Turkey at the time of entry to the Izmir Free Zone.

However, products originating from third countries can be sent to European Union countries by paying customs duty to the Free Zone Customs Directorate at the rate specified in the Common Customs Tariff and after the free movement is started, A.TR certificate can be issued.

|

Possibility of Planning the Future in the Medium and Long Term A building-plot can be provided for the investors who will make production to deliver the title deed immediately. - 15 years for tenant-user companies leasing ready-to-use workplaces, - 20 years for manufacturer-tenant-user companies leasing ready-to-use workplaces, - 30 years for investor-user companies that build their own business, - 45 years for manufacturer-investor-user companies that build their own business, operating license is issued. In addition, lands and buildings that are privately owned by the Treasury can be leased to investor users or servitude rights up to 49 years can be established on them. |

Ease of Trade The provisions of the foreign trade regime are applied in the trade between the Free Zones and other parts of Turkey. Goods sold to the free zone from Turkey are subject to the export regime, and users of the free zone can purchase goods and services from Turkey at the export price (without VAT). On the other hand, the provisions of the foreign trade regime are not applied between the free zone and other countries and other free zones. In addition, in order to ensure the supply of consumables in the regions as soon as possible, goods with a price not exceeding 5000 USD or equivalent in Turkish Lira may not be subjected to an optional export process. |

|

Possibility of Profit Transfer Gains and revenues from free zone activities can be freely transferred abroad or to Turkey without any permission. |

Reduced Bureaucratic Procedure and Dynamic Operating Management All kinds of bureaucracy has been minimized during the application and activity. Free zones are operated by private sector companies. |

|

Possibility of Commercial Activity Free of Customs Tax Procedure Customs duty shall not be paid at the entry of goods of Turkey or EU origin or in free circulation to the free zone to Turkey or EU member countries as the status of being in free circulation does not change. In addition, customs duties are not paid when goods originating in third countries enter the free zone and these goods are sent to third countries other than Turkey or EU member countries. However, for goods originating in third countries which are not in free circulation status sent from the free zone to Turkey or EU member countries, customs duty shall be paid at the rate specified in the Common Customs Tariff. |

Possibility of Providing Free Movement Documents Required by EU and Customs Union Criteria Since the free zones are considered as part of the Turkey-EU Customs Union, it is possible to send products originating in Turkey or EU and products in free circulation in Turkey from the regions to the EU by issuing an A.TR Certificate. Products originating in third countries can be sent to the EU by issuing A.TR Certificate after being released for free circulation by paying customs duty to the Free Zone Customs Directorate at the rate specified in the Common Customs Tariff. |

|

Principle of Equality All domestic and foreign companies benefit equally from the incentives and advantages provided in the free zone. Operators and users can also benefit from non-tax incentives to be determined by the Council of Ministers during the investment and production phases. |

Strategic Advantage Our free zones are located near the EU and Middle East markets, close to major ports in the Mediterranean, Aegean and Black Sea, international airports, road networks, cultural, tourism and entertainment centers. |

|

No Time Restriction The goods may remain in the free zone without time limitation. |

Possibility of Realistic Inflation Accounting All kinds of payments related to activities in free zones are made in foreign currency |

|

Possibility of Commercial Activities to be Freely Determined According to Market Needs and Conditions With the exception of the provisions of the legislation on customs and foreign exchange obligations and the demands of the manufacturing enterprises, the powers granted to public institutions and organizations regarding prices, quality and standards shall not be applied in free zones. |

Possibility of Access to All Domestic and Foreign Markets There is no restriction on the sale of goods from free zones to Turkey and trade between the free zone and other countries. There are no restrictions on the sale of goods from free zones to the country, except for consumer goods and risky goods. |

|

Inexpensive Infrastructure Opportunity Suitable for All Commercial and Industrial Activities The infrastructure of free zones is of the same standard as their counterparts in developed countries. |

Ease of Utilization of Supply Chain Opportunities Free zones offer uninterrupted supply opportunities with world prices and conditions, especially in the supply of intermediate goods and raw materials to companies producing for export. |

İzmir Free Zone is an industrial park and transit loading point that allows a company to enter intense competition in the world market without being subject to various import-export restrictions.

İZBAŞ promotion activities are carried out by the management in Turkey and abroad. In addition to describing İZBAŞ and the free zone in general, companies operating in our region are also introduced in these promotional activities. Thus, it creates additional value for the domestic and international promotion-marketing activities of the companies.

For foreign investors, skilled labor is of great importance. The young, talented, well-educated and productive labor force in Turkey has brought Turkey to the forefront as the most advantageous country in Europe. Employment in İZBAŞ has increased by 114% in the last 5 years.

İZBAŞ's professional team is ready to give you all the information you need to invest in İzmir Free Zone.

Click here to fill in the formİZBAŞ İZMİR SERBEST BÖLGE KURUCU VE İŞLETİCİ A. Ş. © 2022 | ALL RIGHTS RESERVED.